Blogs

The Ultimate Guide to Preserving Your Retirement Savings in Oregon Bankruptcy

Bankruptcy can be stressful and overwhelming, especially if you are worried about losing your hard-earned retirement funds. However, there are ways to protect your retirement savings from creditors and keep them intact for your future. In this article, we will discuss the steps and strategies for protecting your retirement funds in bankruptcy in Oregon.

Short Summary:

- In Oregon, retirement funds like PERS, IRA, 401(k), and 403(b) are protected from creditors during bankruptcy, ensuring that individuals can discharge debts while safeguarding their savings.

- Retirement savings act as a vital financial safety net, allowing individuals to maintain independence and decision-making power, especially during challenging financial times like bankruptcy.

- Familiarize yourself with Oregon’s bankruptcy exemptions specific to retirement accounts.

- Prioritize contributions to recognized qualified retirement accounts for enhanced creditor protection.

- Regularly update beneficiary designations to ensure seamless asset transfer.

- Strategically segregate retirement assets from liquid or accessible assets for added protection.

- Stay informed about legislative changes and economic trends to adapt proactively.

Bankruptcy in Portland, Oregon, like in other parts of the United States, is a legal process designed to help individuals or businesses that cannot repay their debts to either reorganize their finances or obtain relief from certain debts. This seemingly complex topic underscores the importance of informed decisions and strategic planning specific to Oregon’s regulations.

Why Are Retirement Funds Important in Bankruptcy?

Necessarily included in protecting your retirement funds in bankruptcy, it is crucial to understand the importance of retirement funds first. In Oregon, creditors in bankruptcy cannot touch your Public Employees’ Retirement System (PERS), individual retirement account (IRA), 401(k), 403(b), and other qualified retirement accounts. This safeguard ensures that, even if you have dischargeable debts, such as $50,000 in credit card balances, your retirement funds, totaling $300,000, remain fully protected during bankruptcy. That allows individuals to discharge eligible debts while preserving the rest of their qualifying retirement savings.

Declaring bankruptcy can be daunting and overwhelming, casting shadows over one’s financial future. Amidst the myriad of concerns and uncertainties, retirement funds often emerge as a primary point of contention and concern for many individuals. But why are retirement funds so crucial in the landscape of bankruptcy? Let’s delve into the significance and implications.

Financial Safety Net for the Future

At its core, retirement savings serve as a financial safety net designed to provide individuals with a source of income during their non-working years. These funds represent years of diligent saving, planning, and sacrifice, ensuring that individuals can maintain a certain standard of living post-retirement. Protecting these savings during bankruptcy ensures that individuals have resources to rely upon when they can no longer generate income from employment.

Social Security and Limited Income

For many retirees or those nearing retirement age, Social Security benefits may constitute a significant portion of their post-retirement income. Individuals might become overly reliant on these limited benefits if retirement funds are depleted or accessed prematurely due to bankruptcy. Ensuring that retirement funds remain intact allows for a more balanced financial portfolio, reducing dependency on government assistance.

Maintaining Financial Independence

Maintaining financial independence, even amidst challenging circumstances like bankruptcy, is paramount. By safeguarding retirement funds, individuals preserve their autonomy and decision-making power regarding their future. Without these savings, individuals might find themselves at the mercy of creditors, unable to make choices aligned with their long-term goals and aspirations.

Psychological and Emotional Well-being

Beyond the tangible financial implications, retirement funds hold significant psychological and emotional value. Knowing that one has a secure nest egg for the future provides peace of mind, alleviating stress and anxiety associated with financial uncertainty. In the context of bankruptcy, preserving retirement savings can bolster mental well-being, enabling individuals to navigate the process with greater resilience and optimism.

Legacy and Generational Planning

For some, retirement funds represent more than just personal savings; they symbolize a legacy to be passed down to future generations. Whether providing for children or grandchildren or supporting charitable causes, these funds allow individuals to leave a lasting impact and fulfill their generational aspirations. Protecting retirement savings during bankruptcy safeguards these legacy intentions, ensuring that individuals’ hard-earned assets serve their intended purpose.

What Steps Should I Take to Ensure My Retirement Funds Are Protected in Bankruptcy?

Navigating the intricate world of financial planning requires foresight, diligence, and a proactive approach, especially when safeguarding crucial assets like retirement funds. In today’s volatile economic landscape, taking strategic steps to protect these savings is critical. In protecting your retirement funds in bankruptcy in Oregon, you have to take note of the following efficient strategies:

Understand Oregon’s Bankruptcy Exemptions

Familiarize yourself with Oregon’s specific bankruptcy exemptions related to retirement funds first. State laws often provide protective measures for certain retirement accounts, ensuring they remain untouched during bankruptcy proceedings. By understanding these regulations, you can leverage them to your advantage and navigate financial challenges confidently.

Opt for Qualified Retirement Accounts

Prioritize contributing to qualified retirement accounts recognized under federal and state laws, such as 401(k)s, IRAs, or pension plans. These designated accounts often benefit from enhanced protection against creditors and bankruptcy proceedings, shielding your savings from potential liquidation or seizure. Regular contributions to qualified accounts demonstrate a commitment to long-term financial security and fortify protective measures.

Regularly Review and Update Beneficiary Designations

Periodically reviewing and updating beneficiary designations for your retirement accounts is essential. Ensuring accurate and up-to-date information guarantees that your assets transfer seamlessly to intended beneficiaries, bypassing potential probate complications or disputes. By maintaining meticulous records and addressing life changes promptly, you can preserve the integrity and intent of your retirement savings.

Separate Retirement Assets from Liquid Assets

Strategically segregating retirement assets from liquid or accessible assets can bolster protection measures. Consider establishing trusts or specialized accounts to insulate retirement funds from potential creditors or legal actions. This strategic separation creates a distinct financial barrier, safeguarding your savings and mitigating risks associated with external liabilities.

Stay Informed and Remain Vigilant

In today’s dynamic financial landscape, staying informed about legislative changes, tax implications, and economic trends is crucial. Regularly monitoring industry updates, consulting legal resources, and participating in financial education seminars empower you to make informed decisions and adapt to evolving circumstances proactively. Knowledge is your most potent weapon in preserving retirement security and navigating potential challenges.

Learn More About Protecting Your Retirement Funds in Bankruptcy!

In protecting your retirement funds in bankruptcy in Oregon, you will inevitably deal with plenty of legal concepts and complicated terminologies. Northwest Debt Relief Law Firm is the one that you can rightfully trust when dealing with complex situations. Our experienced bankruptcy attorneys offer complete court representation and free lifetime support.

Other than liquidation bankruptcy and reorganization bankruptcy, we also offer practical guidance in rebuilding your credit after bankruptcy. Get free debt solution consultations today!

IRS Grants Automatic Relief To Millions In Taxpayer Penalty WaiversThe story can be found at https://www.pelhamplus.com/finance/irs-grants-automatic-relief-to-millions-in-taxpayer-penalty-waivers/

Jim Shenwick, Esq 917 363 3391 [email protected] Please click the link to schedule a telephone call with me. https://calendly.com/james-shenwick/15minWe held individuals & businesses with too much debt!

Robert traded his 2007 Ford Mustang on a new Ford Focus shortly before filing Chapter 13 bankruptcy.

Virginia bankruptcy lawyer Kaitlin Vaillancourt worked with me on this Chapter 13 appeal.

Thomas Gorman, the Chapter 13 trustee, objected that was “bad faith.” Robert said it was prudent planning–he needed a newer, more efficient car to get through a five year Chapter 13 plan.

The bankruptcy judge agreed with Robert. And today the US District Court affirmed.

You can read it here. Wolf appeal decision

Most people who file bankruptcy never go to the bankruptcy courthouse.

About a month after your bankruptcy papers are filed, you have to attend a bankruptcy trustee hearing. (Also called a “meeting of creditors” or a “341 hearing.”) Those routine and they are done on Zoom.

When something is NOT routine, we have to go in front of the bankruptcy judge at the bankruptcy courthouse.

Where is that bankruptcy courthouse?

Here’s the address for the Alexandria Virginia Bankruptcy Courthouse.

U.S. Bankruptcy Court

200 S. Washington St.

Alexandria, VA 22314-5405

That’s on the corner of Washington Street and Prince Street. Here’s a picture:

200 S Washington St. Enter the side door, on Prince St. Phones are NOT allowed in the courthouse.

200 S Washington St. Enter the side door, on Prince St. Phones are NOT allowed in the courthouse.

The bankruptcy court in Alexandria VA serves all of Northern Virginia. The Alexandria Virginia Bankruptcy Court serves Alexandria, Arlington, Falls Church, Fairfax, Fairfax City, Loudoun, Prince William, Manassas and Manassas Park, Fauquier, and Stafford.

Leave your phone in your car

You can’t bring your phone into the courthouse. That’s a security requirement and there are no exceptions.

Also, for security reasons the front door is now locked. You need to enter by the side door on Prince Street. And you’ll need your drivers license or picture ID.

The Alexandria bankruptcy court has two judges

The courtroom for Judge Brian F Kenney is on the second floor. Judge Klinette H Kindred is on the third floor. (If you are not sure which judge you have look at the three letters after your case number. BFK stands for Judge Kenney. KHK stands for Judge Kindred.)

200 S Washington St – Google Maps

200 S Washington St – Google Maps

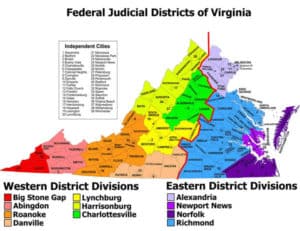

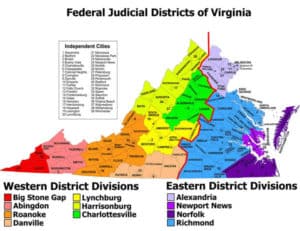

The bankruptcy court in Alexandria VA serves all of Northern Virginia. The Virginia bankruptcy court is a federal court. The Federal Court system divides Virginia into Eastern and Western districts.

We’re in the Eastern District, Alexandria Division

We’re in the Eastern District, Alexandria Division

The Eastern District has four divisions: Alexandria, Richmond, Newport News and Norfolk.

The Alexandria Virginia Bankruptcy Court serves Alexandria, Arlington, Falls Church, Fairfax, Fairfax City, Loudoun, Prince William, Manassas and Manassas Park, Fauquier, and Stafford.

The FDCPA requires that a debt collector sue you in the right judicial district.

Virginia is divided into Judicial Districts. You can see that map here.

In Northern Virginia, most district are one county. But Loudoun and Fauquier share one district. Stafford is in with Fredericksburg and Spotsylvania. So if you live in Stafford, they can sue you in Spotsy. And if you live in Fauquier, they can sue you in Loudoun. Right?

That’s what we thought.

But the Seventh Circuit just came down with a new rule for FDCPA Venue.

They said basically if there’s a separate courthouse in each county, then they have to sue you in the right county.

Now the Seventh Circuit is over in the mid-west. The Fourth circuit are the judges that oversee the courts in Virginia. So this Seventh Circuit rule does not necessarily apply here. But it might.

I hate it when debt collectors do illegal stuff to my bankruptcy clients. And I sue them when I can.

So I’m keeping an eye on whether other judges agree with the Seventh Circuit on this.

What Is Bankruptcy?

Bankruptcy gives a fresh start to honest debtors. That’s what the Supreme Court said more than seventy years ago. A fresh start to honest debtors and a clear field for the future. (As an aside, we know how hard it can be to decide if bankruptcy is right for you, that’s why we encourage you to read our many client reviews.)

There are about as many bankruptcies in America each year as there are divorces–about a million. This year there will be ten thousand in Northern Virginia.

Recently the biggest cause of bankruptcy in Northern Virginia is people getting caught in the real estate crisis, and people losing their jobs in the recession. Historically, most people filed bankruptcy because of medical problems, or job loss. Many people because of a breakup of a marriage or loss of a spouse. Some people just charged too much when things looked good.

What Are The Bankruptcy “Chapters”?

You have two main choices under the bankruptcy law–Chapter 13 and Chapter 7.

Chapter 13 is a debt adjustment. The court works out a payment plan you can afford. Chapter 13 may be required for higher income people. The new bankruptcy law was promoted as an effort to force more people to file Chapter 13. Mostly it hasn’t. Bankruptcy lawyers have been pretty successful at working with or working around the requirements of the new law.

Chapter 7

Chapter 7

Under Chapter 7, most unsecured debts are discharged–they’re gone. (You usually cannot be discharged from taxes, student loans, or child support. You also cannot be discharged from credit cards you agreed to pay as part of your divorce.)

Our law firm thinks that Chapter 7 is better for most people. It’s over quicker and gets you back to good credit much sooner. We try everything we can to qualify people for Chapter 7 if they need Chapter 7.

Chapter 13

Chapter 13 is good to stop the foreclosure on your house and give you time to catch up.

Chapter 13 can also be used creatively to fix a variety of unusual problems. (Some of which I can’t put in writing). If you agreed in your divorce to pay certain bills–I’m not talking about support here, but if your property settlement was a really a “debt” settlement–Chapter 13 can get rid of those.

(You hear in the news about Chapter 11. Chapter 11 is for business–usually big business. Chapter 11 is a plan to pay some debts, wipe out others, and keep the business going. People who owe a million dollars on their house may be required to file Chapter 11–we’re starting to see some of that now.)

Chapter 13 is price controlled by the bankruptcy judges. In August 2023, they set the fee at $6339.

We get about half up front, and the rest out of the Chapter 13 payment you make to the court.

So up front, $700, $1000, and $1100. Then $3529 from your payments–that works out to $65 a month over a five year Chapter 13.

Here’s the Chapter 13 fee Agreement

Your Bankruptcy Papers

“Here are the papers we sign and file, to get your bankruptcy officially started. This is a half-hour video.”

Updated daily, this blog will keep you informed on the latest bankruptcy news!

Updated daily, this blog will keep you informed on the latest bankruptcy news!  Learn more about how Bankruptcy works and what you need to know.

Learn more about how Bankruptcy works and what you need to know.